Contents:

Each selection is chosen considering the aforementioned section, primarily focusing on fees, minimums, and customer service. Most online brokerages also charge administrative account fees determined by the assets you hold in a single account or the size of your portfolio across all accounts. If you have a smaller portfolio, these fees will heavily erode your returns, so it’s best to choose a brokerage that doesn’t charge those smaller portfolio fees. There are very strict Canadian regulations on all of this stuff, and being a member of the IIROC, all the Canadian discount brokerages adhere to high safety standards. If you’re new to investing online, there will be a learning curve when you begin building your portfolio and making your first trades.

- This is, for example, when Binary Options Trading the case that is not very transparent and can cause high losses in a short time.

- I had opened Activtrades UK due to investing more and being protected by FSCS in case of insolvency.

- ActivTrades is one of the more decent brokers on the trading markets, and you’ll see why in a few moments.

- This phenomenon can be found in all companies, but especially those from the Internet.

- This was my first new desk ever, my old desk was bought used from the UWO in London – many decades ago.

- Read our guide on how to buy stocks in Canada for a complete, step by step guide for opening your brokerage account.

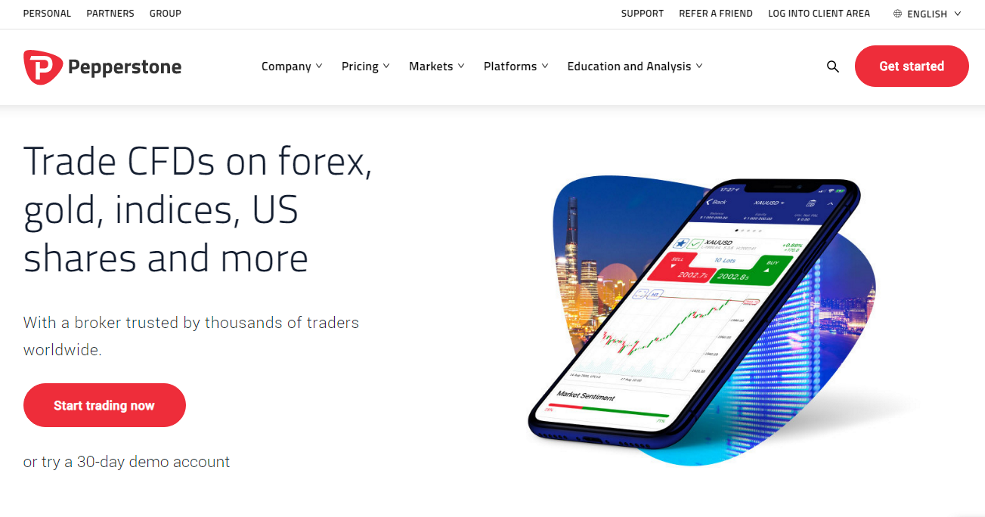

Questrade charges a penny-per-share-traded – but with a minimum of $4.95, and a maximum of $9.95. Personally, I’ve never bought more than 495 shares of a stock or unit of an ETF before – but I’d like to have an account big enough to try it some time. ActivTrades offers a wide range of financial products including major currency pairs on the Forex market , gold and silver, in addition to CFD stock indices , equities and commodities ,such as natural gas. All of these instruments can be traded on the popular platforms MetaTrader 4 and MetaTrader 5. Each has its peculiarities, so we hope everyone can be satisfied with our services.

The number of trading platforms really…

We paid the highest investment fees out of all the other developed countries on this list. After all, the end goal is to make money – not flush it away on unnecessary expenses such as buying yachts for mega-wealthy yacht owners.. Scotia iTrade is particularly attractive for those who want to deposit large amounts of money and be very active with their accounts. If you do that, then it somewhat mitigates the higher fees and the overall convenience and ease of use really shines through. The mobile app in particular has been much criticized.

Each https://forex-reviews.org/ provides its customers with its own trading software. This is designed to provide all the necessary information on the various courses in a clear and intuitive way. Usually, everyone can come to terms with the basic features of the software within a short time. Therefore, traders should inform themselves before signing up not only about the maximum lever, but also about the individual levers for certain CFDs if they plan to trade with exactly these. In the section of the maximum lever we say what to think of the offer. With a higher leverage, it is possible to make more profit in the end by making lower bets and deposits.

A low-fee robo advisor provides a hands-off and automated investment experience.

It might be surprising to most beginning investors to find out that most investors spend the vast majority of their time worrying about Category 2 than they do Category 1. When it comes to investing there are two categories that DIY investors need to seperate all new information into. This insurance covers each investment account to $1 Million. That’s $1 Million each for your RRSP, TFSA, non-registered, etc. Customer service rating took a real hit the last couple of years – the main reason we now rank Qtrade ahead of Questrade. Stock trading in Canada used to be extremely cumbersome and costly, with $30+ required to post a single buy or sell order.

More than many others, activtrades review has created a mini-me app that reflects the high level of utility in the website, including a quickie chart that shows portfolio results over the past year. Online, there’s a Portfolio Score tool that slices and dices your holdings to provide insights on returns, fees, downside risk, income and environmental, social and governance factors. The new 2023 Surviscor rankings coming out for Canadian online brokers were recently released, and as expected, my preferred brokerage continue to take the top spot.

Fender Player Plus Active Meteora Bass review – Guitar World

Fender Player Plus Active Meteora Bass review.

Posted: Wed, 29 Jun 2022 07:00:00 GMT [source]

For this purpose, we have developed various categories for which we will test the broker in a structured manner. Whether you’re new to self-directed investing or an experienced trader, we welcome you. I’m not just singling out this article, because all brokerage comparisons seem to omit margin charges.

Reviews

(I was told this is very uncommon as they have been ordering from this company for 30 years!)After asking if I can fix this, the owner called me up and said he would replace it. They kindly delivered it to me before Christmas. I am very grateful that they got it to me before then. I was also looking for a chair and again, Rodney helped me by asking what I liked or needed in a specific office chair and he sent me a selection online. From the start of the sale, they sent me confirmations, updates and even a Christmas e-mail. A special thanks to Blair for extending fabulous customer service.

Indeed, I ain’t wanna exclude some minor drawbacks that may be found by other enthusiasts. Nevertheless, they are just trifles on the background of the overall services quality. There are some traders who treat new brokerage companies with a touch of suspicion. Undoubtedly, it’s not a kind of ignorance; it’s obviously constituted by the fear of facing an improper company. I was kinda suspicious about joining a new company, because it always implies risks.After trading here for a while on MT4 demo account, I realized there is nothing to be scared of. The company is distinguished by fast withdrawals, appealing trading conditions and opportunities to grab some knowledge.

The test of support

However, it should be mentioned that trading CFDs is also a risk precisely because of these levers. Because just as quickly as high profits can be achieved, it is also possible to have to accept larger losses. We must therefore always look at the maximum lever in a differentiated way. The second part of our review of CFD brokers relates entirely to the overall offer.

Best High Leverage Forex Brokers in 2023 – InvestingReviews.co.uk

Best High Leverage Forex Brokers in 2023.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

While their mobile app isn’t the best, it is also a very good product and overall user reviews are very positive. The only real competitor to Qtrade when it comes to offering well-rounded broker features for rock-bottom prices is Questrade. Read on to find out why we have Questrade at #2, and what types of investors might benefit more from the other trading platforms we review. Indeed, we bet on convenience and simplicity, but at the same time, we always think of a way how to implement technically complex things in trading activity and to make it far more transparent. We work daily on our services, and our team believes that technically equipped platforms and contemporary tools help particular traders to get through market difficulties easier.

Contact our trade desk, Monday to Friday, 7 am to 6 pm ET and an Investment Representative can help answer your questions. I opened three accounts with Questrade yesterday. One was a LIRA on which I messed up the application. I called their customer service line and was speaking with a rep in less than a minute. He solved the problem I had and offered to stay on the line as I filled out the account.

We still think the Qtrade vs Questrade decision is the way to go if you’re a dividend investor or index investor who wants to dabble with a “core and explore portfolio”. Qtrade’s customer service can help smooth out any unexpected mistakes, while Questrade’s slightly lower non-ETF price-per-trade has to be more heavily weighted when you’re making several trades each day. Qtrade is our overall pick for the best online broker in Canada. Their combination of low prices, elite customer service, and constant innovation is simply the best in class.

They give you all the help you need to understand whatever it is you’re going to trade in. The speed of the trading platform.In addition, I like the speed at which I deposit and withdraw funds from my trading account.Thanks to all this, I am satisfied with my work with the broker. I started trading with this broker last year and although I do not have a lot of experience, I can say that not all brokers are this good at what they do. I hedge my trades and the dynamic leverage here is magnificent. The ActivTrades team is happy to hear such sincere, prudent and objective words about our company!

We have always been pleased with our service from your team.Our organization has dealt on several occasions with multiple team members. They are both extremely knowledgeable, and work well with us to ensure we are meeting our organizational needs, in a quality of product that is suitable for our environment. Their delivery team was incredibly helpful and their sales team checked in often to make sure everything was going smoothly. We were able to set up the desk raising desks very quickly and easily.

- All these and some other questions are addressed in the section on deposits and withdrawals.

- With the TD Webbroker, they have arguably the best trading platform in Canada – at least for desktop users.

- They had to wait for a volume order for the item that is not normally carried in Canada so the order took a little while longer.

- Their delivery team was incredibly helpful and their sales team checked in often to make sure everything was going smoothly.

- In any case, this also includes support and customer service for us.

- Undoubtedly, it’s not a kind of ignorance; it’s obviously constituted by the fear of facing an improper company.

Most of the companies are headquartered in other European countries, the majority in Cyprus. Cyprus is interesting because taxes are significantly lower there than in other EU countries. It should be noted that the brokers are then controlled and regulated by the CySEC, the financial supervisory authority based there. This, in turn, is subject to the requirements of the EU. As a result, there are no differences between the regulations of, for example, the BaFin, the FCA and CySEC.